Unlock Your Life Policy's Potential with Expert Life Settlements

Unlock your life insurance policy's potential with McNdam Consulting. Secure, expert brokerage services tailored to maximize your financial freedom. Get a free policy evaluation today!

Unlock Your Life Policy's Potential with Expert Life Settlements

Unlock your life insurance policy's potential with McNdam Consulting. Secure, expert brokerage services tailored to maximize your financial freedom. Get a free policy evaluation today!

Click Play on the Image Below to Learn More:

Click Play to Learn More:

Explore Our Tailored Life Settlement Solutions

Maximize your financial freedom with tailored life settlement solutions.

Comprehensive Life Settlement Evaluations

Life Settlement Evaluations: Comprehensive policy assessments to ensure maximum value from potential life settlements for existing life insurance policies.

Expert Brokerage Services

Our experienced team mediates transactions between policyholders and investors, ensuring optimal outcomes in life insurance settlements.

Policy Continuation Advice

We offer guidance on whether to keep your insurance or pursue a settlement, analyzing the long-term financial impacts and benefits.

Continued Financial Planning Support

Financial Guidance Post-Settlement: We assist clients in efficiently managing and investing the proceeds from their life settlements to maximize long-term financial benefits.

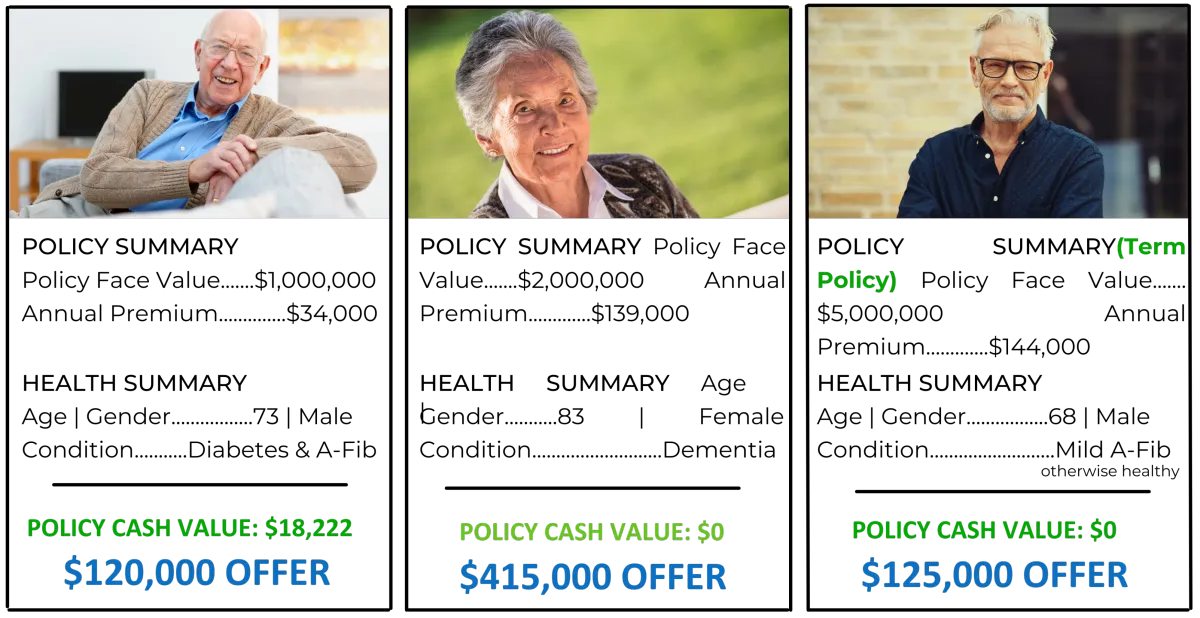

Real Settlements Provided By Our Company

FAQs

Your Questions Answered: Understanding Life Settlements

What is a life settlement?

A life settlement involves selling your life insurance policy to a third party for a value greater than its cash surrender value but less than its net death benefit.

How do I know if my policy qualifies for a life settlement?

Policies usually qualify if they are longstanding and the insured is 65 or older. We provide complementary appraisals at no cost or obligation.

Is selling my policy the only option?

No, you always have a choice! You can continue with your policy as is, convert it if that option is affordable for you, or choose a Life Settlement to receive cash from your unwanted or unaffordable policy now.

How long does the life settlement process take

The process typically takes 4-9 weeks from start to finish, where you'll receive the funds via check or wire directly into your bank account.

Are there any risks involved in life settlements?

While a life settlement can offer immediate financial benefits, there are considerations such as losing the death benefit and potential tax implications. We discuss these thoroughly to help you make an informed decision.

How is the value of my policy determined?

The value is influenced by factors like policy size, health, premium costs, and life expectancy.